Describe Methods Used to Calculate Depreciation

Next apply the resulting double-declining rate to the declining book. In addition to straight line depreciation there are also other methods of calculating depreciation Depreciation Methods The most common types of depreciation methods include straight-line double declining balance units of production and sum of years digits.

Depreciation Definition Types Of Its Methods With Impact On Net Income

6 ways to calculate depreciation.

. Below we will describe each method and provide the formula used to calculate the periodic depreciation expense. It is the simplest method of depreciation. Straight Line Method is the simplest depreciation method.

A fixed percentage is written off the reduced balance each year. First week only 499. Solution for Describe the three different methods used to calculate the periodic depreciation allowances for financial reporting.

The company will record a depreciation expenses of 14000 for the year 2018. Annual Depreciation FC - SV n Total Depreciation after five years FC - SV 5 n Book Value FC - Total Depreciation. It assumes that a constant amount is depreciated each year over the useful life of the property.

Depreciation fracEstimated Total Cost Residual valueEstimated total output units x Actual output during the year units Machine hour rate or Service hours Method. Double Declining Balance Depreciation Method. The formulas for Straight Line Method are.

There are different types of depreciation methods such as straight line depreciation reducing balance depreciation sum of the year digit depreciation and units of activity depreciation. Double-declining-balance method To apply the double-declining-balance DDB method of computing periodic depreciation charges you begin by calculating the straight-line depreciation rate. Depreciation Methods 4 Types of Depreciation Formula Calculation 1.

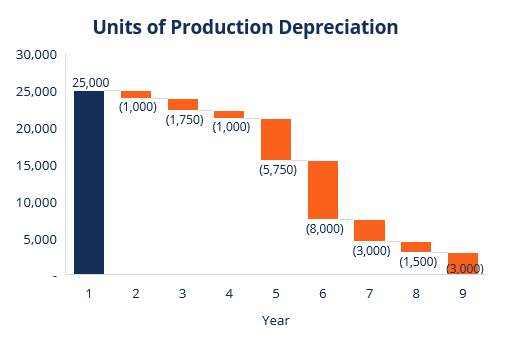

Units of production depreciation method. The annuity method of. This method in particular takes the assets expected life and adds the digits for each year together.

Reducing balance method. Start your trial now. Straight Line Depreciation Method.

Calculate depreciation expense for the year 2018 using activity method of depreciation. Depreciation is handled differently for accounting and tax purposes but the basic calculation is the same. For tax MACRS is the relevant depreciation method.

This method is suitable in case of textile and jute mills. A depreciation method is the systematic manner in which the cost of a tangible asset is expensed out to income statement. Then select a depreciation method that aligns best with how you use that asset for the business.

As the name suggested the earlier period shows higher. First determine an assets useful life salvage value and original cost. To do this divide 100 per cent by the number of years of useful life of the asset.

Hence the calculation is based on the output capability of the asset rather than the number of years. Under this method the hourly rate of depreciation is calculated and thus the actual depreciation depends on the working hours during the period. Calculate per unit depreciation.

Cost of the asset-residual value nr of years an asset is expected to be used for. Depreciation is calculated using the following formula. Some of the most common methods used to calculate depreciation are straight-line units-of-production sum-of-years digits and double-declining balance an accelerated depreciation method.

The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life. The written down value method also known as diminishing balance method or reducing balance. Various Depreciation Methods.

Discounted Cash Flow Method. In this method depreciation expense. Calculating depreciation is a two-step process.

If an asset was expected to last 4 years the sum of the years digits would be obtained by adding 4321 to get a total of 10. The two most common methods of calculating depreciation are. Double Declining Balance Method.

The sum-of-the-years-digits depreciation method is a faster method for calculating an assets depreciation. Taking depreciation expenses each year is a way to reduce your business tax bill. The wheel loader will be fully depreciated after completing 15000 hours of work that is its productive life.

Per unit Depreciation Asset cost Residual value Useful life in units of production Step 2. Companies must remain cautious about the selection of depreciation methods. Written Down Value Method.

Other Methods of Depreciation. Under US GAAP there are four methods of calculating depreciation a company may use. You can calculate straight-line depreciation by subtracting the assets salvage value from the original purchase price and then dividing it by the total number of years it is expected to be useful for the company.

Then multiply this rate by 2. The straight-line method of depreciation is the most simple and easy to use depreciation method. A D V E R T I S E M E N T.

Some methods such as double-declining depreciation are used to accelerate the depreciation charge initially. Popular depreciation methods include straight-line method declining balance method units of production method sum of year digits method. Net Book Value USD 105000 first year equal to the cost of the car Residual value USD 5000.

There are several methods to calculate depreciation. Each method has its own impact and individual pros and cons. Straight-line method of depreciation.

It means the charge or expense will gradually decrease in the following years. Different methods of asset depreciation are used to more. The Modified Accelerated Cost Recovery System MACRS is the current tax depreciation system used in the United States.

Use the diminishing balance depreciation method to calculate depreciation expenses. Weve got the study and writing resources you need for your assignments. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value Residual value X Depreciation Rate Here is the value of each element.

Managers can manipulate the usage of depreciation to. The straight-line depreciation method results in equal depreciation expenses spread evenly over the course of the assets useful life. Double-declining balance method.

Sum of Years Digits Method. Calculate the total depreciation of actual units produced.

Depreciation Methods 4 Types Of Depreciation You Must Know

Comments

Post a Comment